Last Thursday, March 9, the state Board of Revenue Estimates provided its “March estimate.” This revises the previous estimate from December, which provided the basis for the Governor to balance the proposed budget.

The March estimate provides an updated basis for the legislature to enact a balanced budget in April. Often, the actual collections and economic news in January and February provide good news, and then the governor and legislature can add to the proposed budget.

The new estimate for the current year (fiscal year 2023) is down $77.4 million. For the upcoming year (fiscal year 2024) the estimate is $400.3 million below the previous estimate. That’s a total of $477.7 million less to support the budget now in front of the legislature.

The write-down is based largely on actual collections since December – especially estimated payments of individual income tax. These estimated payments mostly reflect investment gains and business income. These components of the tax base are very volatile and difficult to predict.

The sales tax estimate also went down.

Corporation income taxes increased, as did the estimate of interest on investments. These only partially offset the reductions in individual income tax and sales tax.

What Happened to the Surplus?

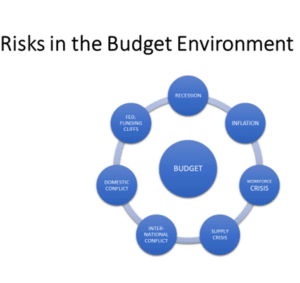

In January, we were talking about “the days of miracles and wonder.” Well, we also were careful to caution you about the potential risks to the budget in the external environment. We included this slide in Maryland Nonprofits’ budget briefings, and other commentators made similar cautionary statements.

“Recession” was at the top of the list. The revenue estimators are NOT projecting an actual recession at this point. However, the economy is slowing more than the December estimates had assumed. This has indeed harmed the revenue estimates and thereby the basis for the proposed budget.

Small percent – big dollars

This revision is actually a small adjustment, in percentage terms.

In FY 2023, the revision is 3/10 of one percent. Underlying revenue growth is still projected to be 2.1% over the previous year.

In FY 2024, the revision was 1.5%, and the revised year-over-year revenue growth is 1.0%

At almost $25 billion, the state general fund budget is so big, that a modest percent change in the estimate yields quite a large change in the dollar amount.

So, What Does this Mean For the Budget?

The Department of Legislative Services has compared the budget picture before and after the revision.

| The Budget Picture In January

General Funds – millions of dollars |

||

| Cash balance | Structural balance

(ongoing revs. & exps.) |

|

| As proposed by Governor | $820.0 | $340.0 |

| Spending Affordability Target | $350.0 | $100.00 |

| Amount Available | $470.0 | $240.0 |

The chart shows that the Governor’s budget would have left a general fund cash balance of $820 million. We can think of this as the state’s checking account balance. The legislature’s Spending Affordability Committee had set a target of $350 million. That was why we thought there could be $470 million available for a supplemental budget, of which $240 could be ongoing expenses, with the rest available for one-time capital projects.

| The Budget Picture In March

General Funds – millions of dollars |

||

| Cash balance | Structural balance

(ongoing revs. & exps.) |

|

| As proposed by Governor | $820.0 | $340.0 |

| March Revenue Revision | -$477.7 | -$400.3 |

| Revised Balance | $342.3 | -$60.3 |

| Spending Affordability Target | $350.0 | $100.00 |

| Amount to Cut | $7.7 | $160.0 |

(Source Department of Legislative Services)

Now the balance is $342 million. That’s still a large balance by historical standards. Recently, the budgeted general fund balance has been closer to $200 million. But the new projection is very close to the target that the Spending Affordability Committee set prior to the legislative session. So, unless the legislature were to alter its budget target, there’s no room for supplemental budget items.

The “structural” column is a more serious concern. The structural budget calculation compares ongoing revenues against ongoing spending. It strips out one-time revenues (like prior balances and transfers from reserves) and one-time expenses (like capital project funding and payments into reserves). It is normally a good financial management practice for on-going revenues to exceed on-going expenses. That’s the definition of a “structural surplus.”

The Spending Affordability Committee set the target for the budget to leave a structural surplus of at least $100 million. With the write-down, and the Governor’s proposed spending, there will now be a $60 million structural budget deficit. That leaves a $160 million gap between the budget and the target.

Expectations Were High

Because the new projected cash balance is close to the Spending Affordability target, there is no room to fund additional spending from the fund balance.

The Governor’s Office and the legislature have been overwhelmed with requests for new spending initiatives. Maryland Nonprofits encouraged our members to put (well-considered) requests forward. Now it appears few of those will be successful.

Equally concerning: the structural budget calculation means that the legislature will need to trim $160 million in ongoing spending to meet that Spending Affordability recommendation.

I’m a veteran budgeter. When budgeters look for places to cut, we look at things that are big, are growing a lot, and/or are new. Governor Moore’s new budget initiatives are obvious targets. Anything new that could be delayed, deferred, scaled back, or cut out could be at risk. Provider rate increases, behavioral health initiatives, SNAP (Supplemental Nutrition Assistance) Medicaid dental enhancements, and employee compensation increases could all be at risk.

Some Perspective: The Sky is Not Falling

The news of the revenue write down is a gut-punch because our expectations were so high. It’s important to gain some perspective about the state’s overall fiscal position.

Maryland’s finances are still in the strongest position they’ve been in my 38-year career.

- The budget is balanced…with a historically large general fund balance.

- I am very confident that when the legislature passes the budget next month, it will be structurally balanced as well. In the last thirty years, Maryland has relied on one-time sources to balance the budget more often than not. A structural surplus is not something we should take for granted.

- We are moving forward as planned in funding the multi-year, multi-billion-dollar “Blueprint for Education” (Kirwan) initiative. Aid to public schools increases $900 million in this budget.

- We have a 10% reserve balance in the Rainy Day Fund: $2.5 billion. That’s two times the typical historic percentage. Plus $1 billion is being reserved for future transportation and education expenses.

- The Wall Street credit raters all just reaffirmed the state’s Triple-A credit rating – the highest possible credit score.

- Within the balanced budget, there is still a wide array of increases and initiatives that the nonprofit community has supported, especially to expand the state Earned Income and Child Tax Credits and to address workforce problems.

So, our situation is less utopian and more normal than we thought it was a week ago. But it’s not bad. And there is still a lot to build on.

For nonprofit advocates, we are back to a more normal budget landscape. We need to advocate to protect the important things in the budget, continue to advocate forcefully for our highest priority initiatives, and build on our support and relationships to get funding in future budgets for the things we don’t get this time.