Congratulations to HOPE For All!

Learn More

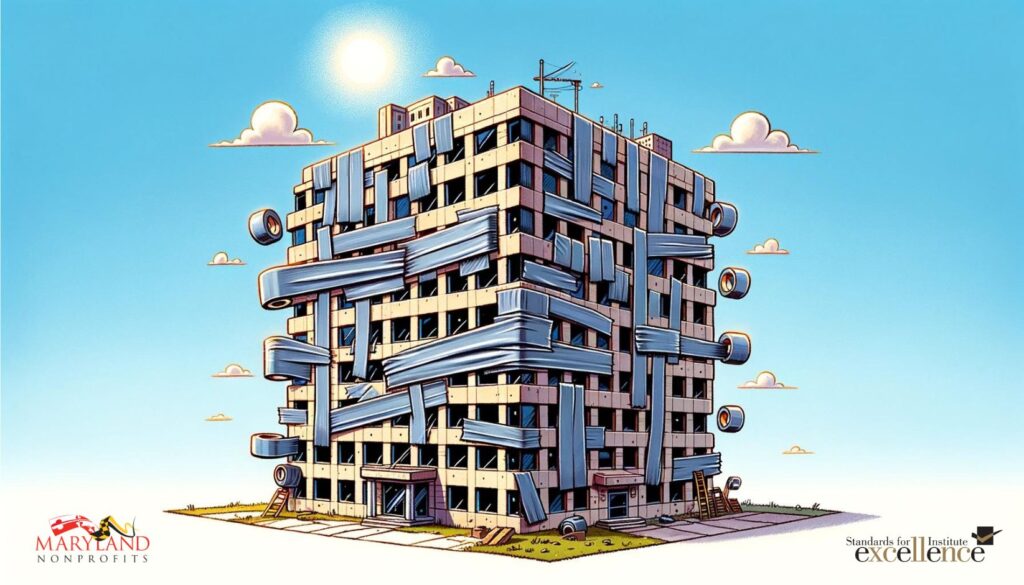

Is every single thing in your organization held together by duct tape?

Learn More

Standards for Excellence® Institute partners with Social Venture Partners Dallas to assist nonprofits achieve the highest governance and management standards

Learn More

Introducing: Standards for Excellence Institute® Licensed Consultants Class of November 2022

Learn More

Introducing: Standards for Excellence Institute® Licensed Consultants Class of November 2021

Learn More